Proposed 20% tax on real estate profits sparks concerns

Ngày đăng: 5/9/2025 2:05:52 PM

A proposal to impose a 20-per-cent tax on profits from real estate transfers could create negative impacts on the housing market and overall accessibility for homebuyers

A proposal to impose a 20-per-cent tax on profits from real estate transfers could create negative impacts on the housing market and overall accessibility for homebuyers.

During the amendment of the Personal Income Tax Law, the Ministry of Finance has proposed two methods for calculating taxes on real estate transfers, depending on the availability of transaction data. The methods aim to reflect the realities of property transactions and improve tax collection efficiency.

Specifically, for the case that has available data on the trading price and relevant fees or charges, each property transaction is imposed personal income tax (PIT) at 20 per cent on the taxable income.

In case data cannot be verified, a simpler two per cent tax rate on the total transaction value is applied.

Under the current regulations, individuals pay a flat two per cent tax rate on the transaction value, regardless of whether the transaction yields a profit. This often leads to under-reporting of sale prices, to reduce the tax payable, causing losses to the State budget and a lack of transparency in the real estate market.

Finance Minister Nguyễn Văn Thắng has emphasised that the first method aligns with the fundamental principles of income taxation by ensuring tax is levied on actual gains.

However, the method’s effectiveness hinges on two critical conditions: a comprehensive and accurate database of land transaction histories and clear legal guidance on costs that can be deducted.

Currently, the taxation department maintains a database that allows searches for land plot and taxpayer transaction histories dating back to 2018.

However, ensuring buyers and sellers declare true transaction values remains a challenge, and building a reliable market price database will require both time and technological tools.

Additionally, identifying and verifying deductible costs in property transfers is complicated. Some expenses - such as land purchase prices, construction, repairs and administrative fees - are straightforward. Others are more ambiguous, including brokerage fees, loan interest, compensation payments, and other miscellaneous costs.

In many cases, especially involving inherited or donated properties, determining the original cost basis is difficult or impossible. The cases would have inaccurate tax declarations and difficulty in assessing taxable income.

A resident in Hà Nội, Hoàng Minh Ngọc, said a home may be held for decades before resale, during which countless expenses, often without receipts, are incurred. These include renovations, maintenance and financing costs, which are typically difficult to document and thus may not be recognised when calculating taxable profits.

The Finance Minister believes that the tax could curb speculation by professional real estate traders, helping moderate market volatility.

However, he also warns that sellers are likely to pass the tax burden on to buyers, pushing property prices even higher.

Unless someone is in urgent need of cash, they will wait to sell, leading to a situation of having a supply, but it is inaccessible in practice, he said.

The southern regional director at Batdongsan.com.vn, Đinh Minh Tuấn, said that accurately determining a property's input cost, especially for long-held homes, would be challenging for tax authorities.

“Costs like brokerage fees, renovations, repairs and interest payments are rarely documented thoroughly,” he said. “A property might show little to no real profit, yet the owner could still face a substantial tax bill.”

For investors, any new tax would simply be added to the selling price, along with brokerage fees, contributing to further price increases, said Tuấn.

So, he warned that it could incentivise under-the-table transactions, reducing transparency and leading to lost revenue for the government.

For end-users - particularly first-time homebuyers - the proposed tax could raise property prices, making it harder to access housing, he said.

Việt Nam currently maintains one of the lowest real estate tax rates in the region, with no tax on profits and overall real estate taxes below 10 per cent. Experts argue that while reform is necessary, it must be balanced and supportive of market development.

Real estate expert Nguyễn Văn Đính proposed reducing the personal income tax rate on real estate transfers to a low rate of 0.5 per cent, for example, while retaining the current tax calculation method based on declared transaction prices.

Such a change would encourage more accurate declarations, helping the government gather reliable market data and develop an accurate land pricing system.

Viet Nam News

.jpg)

Thailand Berli Jucker to acquire MM Mega Market Vietnam in THB22.5 bln deal

Thai conglomerate Berli Jucker Pcl (BJC) plans to spend about THB22.5 billion (more....

International Financial Centre in HCM City prepared to open on December 12

HCM City has prepared the infrastructure, human resources and investors to open and....

Pandanus Resort: A destination to explore Chăm culture and cuisine

Every October, the Kate Festival the most important celebration in the Cham calendar....

Việt Nam’s southern metropolis targets $120 billion economy in 2025

With a projected capacity of 32.7 million TEUs a year, the city could....

Sun PhuQuoc Airways: READY TO TAKE OFF

October 15, 2025, in Hanoi, Sun Group officially held the launch ceremony of....

Vietnam to require electronic ID or kiosks for most flight procedures from December

Only air passengers with checked baggage or those in special categories will be....

Rising US fruit imports find fresh favour in Việt Nam

Việt Nam is seeing a surge in imports from the US, with fruit,....

Free metro rides on Bến Thành-Suối Tiên line on National Day

Passengers can access free rides in one by scanning with a citizen ID....

Việt Nam grants visa exemptions to citizens of 12 countries to boost tourism

The Government has announced a new resolution granting visa exemptions under its tourism....

Việt Nam welcomes 12.23 million international visitors in seven months, up 22% year-on-year

International arrivals to Việt Nam hit 12.23 million in the first seven months....

National Assembly approves limited visa waiver for foreigners in special categories

Under the resolution, the visa exemption will apply to foreign nationals deemed to....

Korean firm apologises, fires employee over assault in Việt Nam

Chun Sung Woog, legal representative of Segyung Vina Co., Ltd emphasised “We are....

Vietnam: Among top 5 destinations for European travellers in summer 2025

According to digital travel platform Agoda, Vietnam has officially entered the top five....

SUN GROUP: PHU QUOC AIRPORT EXPANSION GETS GREEN LIGHT

On June 19, 2025, the People’s Committee of Kien Giang Province held an....

NEW WORLD PHU QUOC RESORT: A NEW CHAPTER OF SOPHISTICATION

New World Phu Quoc Resort celebrated its fabulous fourth anniversary on May 2025....

Vietnam's Michelin star 2025

The 2025 MICHELIN Guide selection in Vietnam features a record 181 establishments: 9....

Government approves Phú Quốc airport expansion ahead of APEC 2027

The Government has authorised the transfer of State-managed infrastructure at Phú Quốc International....

Nha Trang Launches Vietnam's Premier International Yacht Marina

Nha Trang, Vietnam – Following a successful trial period, Ana Marina Nha Trang,....

Buddha’s holy relics arrive in Việt Nam for UN Vesak celebrations

The relics are scheduled to travel to several significant Buddhist sites across Việt....

Traffic restrictions in HCM City for April 30 celebrations

Vehicles will be banned on several streets in downtown HCM City during rehearsals....

Vietnam Sommelier Association Officially Launches

Ho Chi Minh City, 2025 – The Vietnam Sommelier Association (VSA) was officially....

Ministry proposes looser rules on Vietnamese citizenship

The Ministry of Justice has unveiled a draft law proposing easier access to....

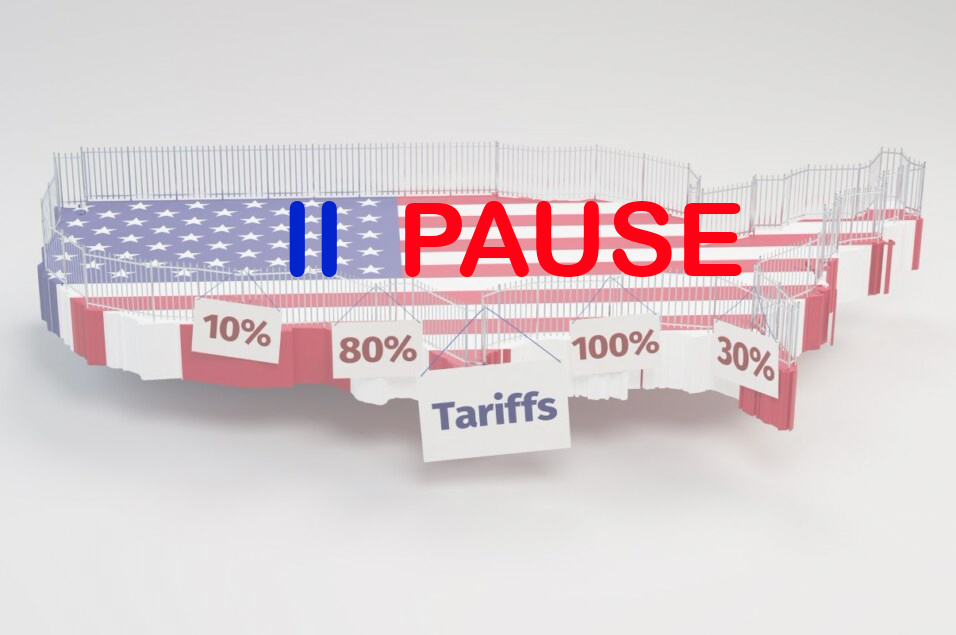

U.S. halts sweeping reciprocal tariffs with key partners, including Vietnam

Vietnam will benefit from a 90-day suspension of steep U.S. reciprocal tariffs, during....

US imposes 46% tax on 90% of goods imported from Việt Nam

US President Donald Trump has announced a 46 per cent reciprocal tariff on....

HCMC to launch new high-speed ferry service to Con Dao

The Ho Chi Minh City - Con Dao ferry route took place at....

Vietnam free Visa: Việt Nam to waive visas for citizens from 12 countries until 2028

These countries include Germany, France, Italy, Spain, the United Kingdom of Great Britain....

Major ao dai festival to take place in HCMC next week

More than 3,000 people will take part in a mass ao dai performance....

.jpg)

Chef La Thua An: A Culinary Fusion of East and West

Chef La Thua An's life journey is one of resilience, passion, and creative....

LA VILLA: CHEF THIERRY JOURNEY TO STARS

In 2010, Chef Thierry and his partner Tina embarked on a culinary adventure,....

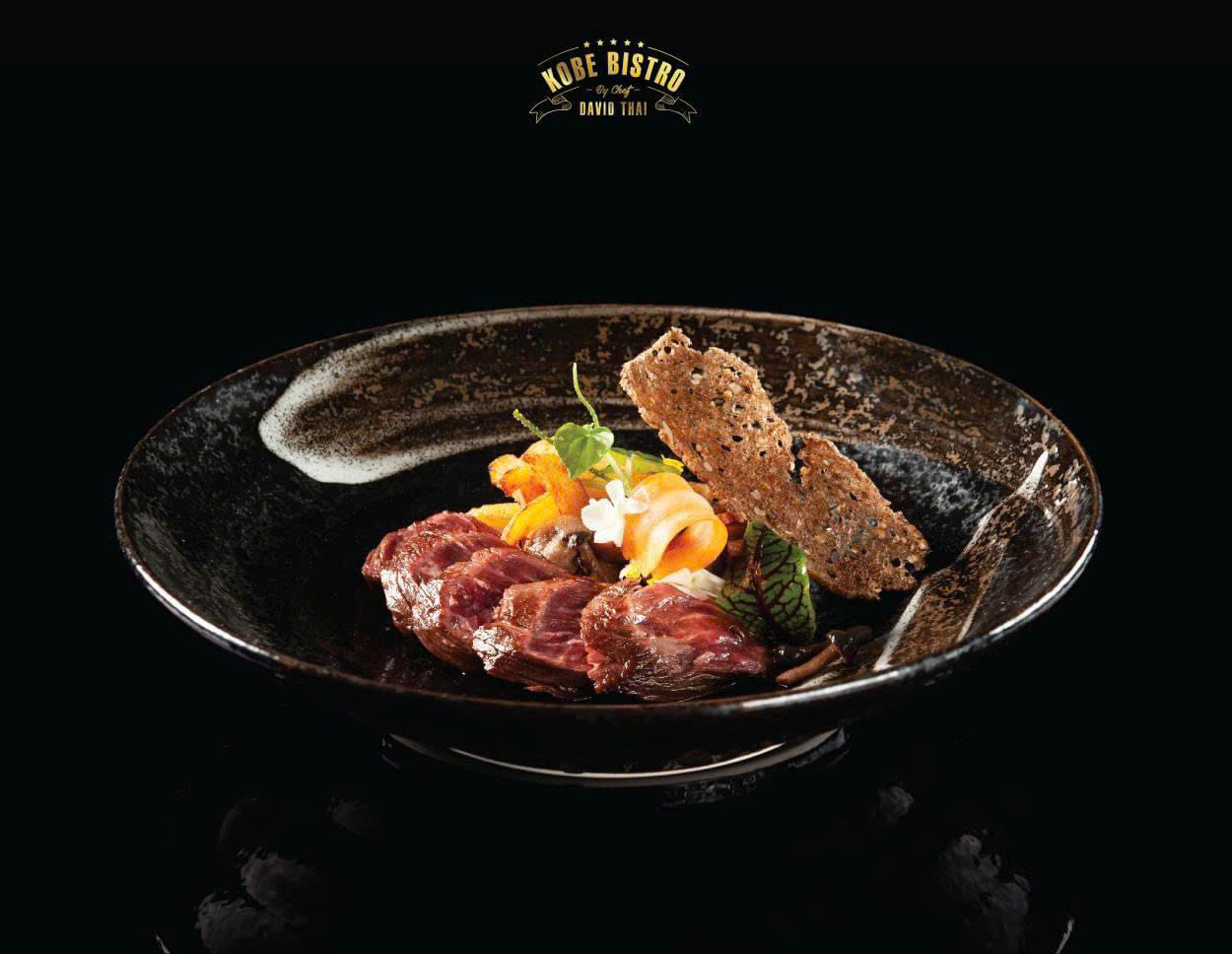

Iron chef David Thai: FROM MICHELIN TO VIETNAMESE FLAVORS

For over two decades, Chef David Thai has been at the helm of....

NÉN: THE FIRST AND ONLY MICHELIN GREEN STAR

Nén is a F&B brand dedicated to exploring the vast potential of Vietnamese....

MADAME LAM: COMTEMPORARY VIETNAMESE CUISINE

Nestled in the heart of City, Vietnam, Madame Lam is a culinary gem....

Michelin 2024 in Saigon: 3 New One Stars, 1 First-Ever Green Star

The 2024 MICHELIN Guide Vietnam features a total of 164 food establishments: 7....

.JPG)

Saigon today: MICHELIN Guide Ceremony

The MICHELIN Guide Ceremony Hanoi | Ho Chi Minh City | Da Nang....

.jpg)

Eastin Grand Saigon: Conference and events offer

Conveniently located between the airport and city center, the hotel offers a range....

Four Việt Nam restaurants receive Michelin stars

The restaurants given the honour are Gia, Hibana by Koki and Tầm Vị....

Booth brings vegan taste to Ho Chi Minh City’s banh mi festival

A booth is offering a vegan option for event-goers at the ongoing Banh....

.jpg)